The second Round regarding PPP Funds Is available: Heres Getting That

The next stimulus bill that includes $285 mil within the investment allocated towards Salary Safety Program (PPP), has become passed by Congress and you can officially closed towards rules by the President. The bill, known as the Consolidated Appropriations Work, 2021 comes with transform so you can PPP mortgage qualifications and you can forgiveness.

PPP funds would be open to first- and next-date borrowers exactly who meet the qualification standards established from the statement. Small businesses, non-earnings, and you can separate contractors are entitled to incorporate. On the other hand, the very first time since beginning of the program, 501(c)(6) nonprofits, plus appeal business teams, regional push, and tv and you may radio broadcasters are in reality entitled to payday loan Westcliffe use.

Even if you already acquired a good PPP mortgage for the earliest stimulus costs, you are eligible to simply take a supplementary mortgage to suit your needs

For those who already grabbed a PPP mortgage into the first stimulus costs, you have got to meet up with the following the requirements since an additional-date PPP borrower to help you safe another loan for your business:

- You truly need to have held it’s place in company since .

- Need lower than 3 hundred staff

- Need to reveal at least a twenty five% drop during the quarterly revenue in either Q1, Q2 otherwise Q3 out of 2020, compared to the exact same one-fourth in 2019

- Organization you to definitely had an initial PPP financing should have made use of, otherwise plan to use, its full PPP financing already acquired.

Beneath the new laws, as much each PPP loan was $dos mil. The particular amount borrowed will be determined by calculating a great business’s mediocre total monthly payroll costs increased by the the one thing out-of 2.5%. People that have an effective NAICS code beginning in 72 (basically hospitality people) could possibly get receive as much as step 3.5 times average month-to-month payroll costs.

To help you qualify for full PPP mortgage forgiveness, you should purchase no less than sixty% of money on payroll. The rest 40% might be used on eligible expenditures eg:

- Rent

- Resources

- Working will cost you and cloud measuring, recruiting, otherwise collection government

- Home loan notice

- Covered vendor can cost you

Once the finally laws and regulations because of it second round regarding PPP resource haven’t yet , already been provided, the small Organization Management (SBA) must provide statutes within this 10 months from the time the bill is actually finalized for the law (Sunday, ). As a result the newest PPP bullet dos loan requests will likely be around during the early January.

According to the the stimulus costs, PPP money will not end up being mentioned since the taxable earnings. It change is for the fresh new and you will current PPP financing and certainly will signify the expenses paid which have good PPP loan are tax-allowable. While doing so, PPP loans having come forgiven will not number because the nonexempt earnings. We advice seeing a good CPA to learn more.

$20 billion might have been spent on the latest EIDL Provides on stimuli package. This type of offers is solely getting businesses in lower-earnings communities just who utilize below five-hundred employees while having sustained a monetary loss of more 29%.

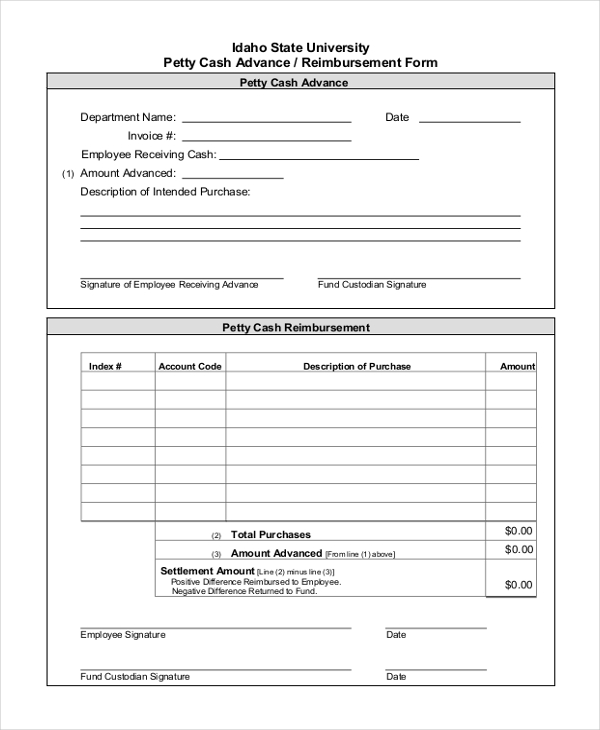

This type would be designed for PPP fund from $150,one hundred thousand or quicker out-of both the very first bullet of your own stimulus plan plus the next that

Yes. The latest SBA features assigned $fifteen million during the dedicated give having alive venues, separate concert halls, and you may social institutions. This type of money should be advice about payroll prices for teams and to possess working will set you back such rent, utilities, and you can fix of the house. It’s important to remember that these businesses can either choose so it give or perhaps the the fresh PPP mortgage. You can’t found both types of resource.

SBG Financial support will be constantly keeping track of people the new developments and will exchange the fresh new pointers whilst gets offered. We realize that the trouble is constantly changing, and you can navigating loan options are going to be state-of-the-art and you will daunting. For this reason we are going to become adding new information and you will information for small business owners influenced by the latest pandemic with the the COVID-19 Investment Cardiovascular system when it gets readily available. For those who have any queries, excite contact us at (844) 2842725 otherwise current email address us during the

*SBG Financial support is not an agent or financial for PPP funds. SBG Resource even offers consultative functions into the a suite from industrial resource services works closely with representatives which are experts in permitting home business owners seeking sign up for PPP Fund. Within the provider, the audience is willing to refer one these agencies that assist make suggestions from procedure free. You aren’t expected to replace your banking relationship in check to use often!